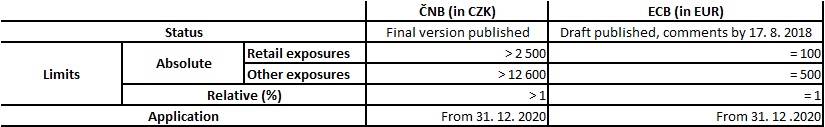

Materiality thresholds for past due credit exposures

The Czech National Bank (CNB) has set materiality thresholds for banks and credit unions in its regulation issued on 29 June 2018. In addition, the CNB issued similar regulation for investment firms on 9 July 2018. According to this regulation, and for the purpose of Article 178(2)(d) of CRR, a past due credit exposure shall be considered material from 31 December 2020, if it exceeds:

- CZK 2 500 for retail exposures and CZK 12 600 for other than retail exposures, and

- 1% of the total amount of all on-balance sheet exposures to that obligor for the credit institution, its parent undertaking or any of its subsidiary, excluding equity exposures.

With this measure, the CNB has set thresholds for the purposes of assessing whether the amount of overdue credit obligation is material. If there is a material obligation for more than 90 consecutive days past due, the debtor is deemed to have failed. Of course, the debtor is also in default if the institution considers that the borrower is likely not to fully pay its credit commitments to the institution.

Several days later, on 3 July 2018, the European Central Bank (ECB) issued a draft ECB regulation on materiality thresholds for past due credit obligations for institutions directly supervised by the ECB under the so-called Single Supervisory Mechanism. Comments on the ECB's draft are expected by 17 August 2018.

The ECB´s draft sets that, for the purpose of Article 178(2)(d) of CRR, credit institutions shall assess the materiality of a credit obligation past due against the following threshold, which comprises two components:

- a limit in terms of the sum of all amounts past due owed by the obligor to the credit institution, the parent undertaking of that credit institution or any of its subsidiaries, equal:

- for retail exposures, to EUR 100,

- for exposures other than retail exposures, to EUR 500, and

- a limit in terms of the amount of the credit obligation past due in relation to the total amount of all on-balance sheet exposures to that obligor for the credit institution, the parent undertaking or any of its subsidiaries, excluding equity exposures, equal to 1%.

The draft regulation envisages the application from 31 December 2020.

The table below summarizes materiality limits according to both regulations.

27-7-2018

© 2025