European Supervisory Authorities on risks and vulnerabilities in the EU financial system

On 7 September the Joint Committee of the European Supervisory Authorities (ESAs) published its regular Report on Risks and Vulnerabilities in the EU Financial System.

The ESAs highlight the main risks and vulnerabilities in the EU, preferably:

- low growth, low yields and low interest rates environment,

- low quality of assets in some jurisdictions and high levels of non-performing loans (NPLs),

- growing competition from non-bank and non-insurance,

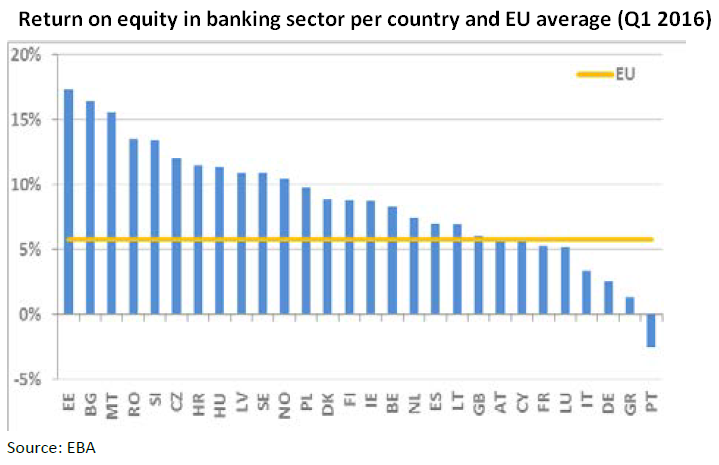

- deteriorating profitability of financial institutions (e.g. „An aggregate return on equity (ROE) of 5.8% as of Q1 2016 appears not to cover banks’ cost of equity.“) and

- interconnectedness in the financial system (including e.g. increases in cross-sectoral exposures, vertical and horizontal integration of financial companies as well as market concentration).

Many of those risks and vulnerabilities have been persisting since 2007 although ESAs also mention more recent risks such as UK referendum on EU membership. Nevertheless, the ESAs remark that the outcome of the 2016 EU-wide stress-test exercise demonstrates resilience in the EU banking sector as a whole thanks to significant capital raising in the past years.

The ESAs indirectly recommend that supervisors should encourage steps to adjust business models in search for sustainable income to ensure that banks remain structurally resilient and viable in the longer term. The question is whether such models are immediately available or whether we need some deeper economic reforms before.

© 2024