Securitisation Regulation

Securitisation is a transaction that enables a lender – often a bank - to refinance a set of assets (e.g. mortgages, consumer loans, credit cards) by converting them into securities that others can invest in. The securities may be adapted to different investor risk/reward characteristics. The end investors are repaid by the cash-flows generated by the underlying assets. It is generally recognized that the securitisation of subprime mortgages created in the US contributed greatly to the financial crisis of 2008. European Commission states that securitisations which, according to their credit ratings (AAA) should have had a 0.1% probability of defaulting, defaulted in 16 % of cases and generated sizeable losses across the globe. Thus investors lost trust in all securitisations.

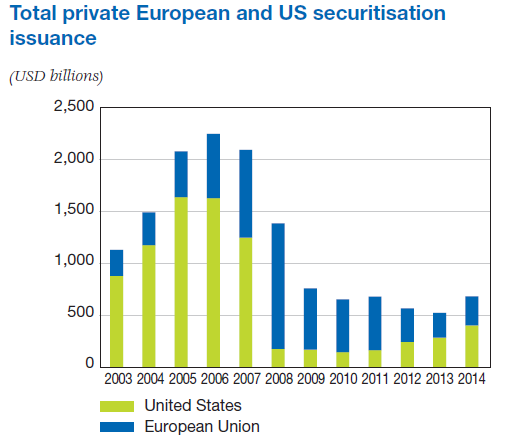

However, securitisation is often mentioned as an important element of well-functioning financial markets. In contrast to US markets that recovered from the subprime crisis, European securitisation markets remain subdued, despite that far fewer European securitised products defaulted. (See the graph below.) This difference is usually attributed to various reasons, notably the lack of public sponsorship of European securitised products.

Source: Segoviano Miguel et. al., 2015 https://www.banque-france.fr/fileadmin/user_upload/banque_de_france/publications/Revue_de_la_stabilite_financiere/2015/FSR19_4_IFM.pdf

On 30 September 2015 the Commission set out a “Securitisation initiative“ which includes a Securitisation Regulation. This regulation is a part of wider Commission efforts to build a Capital Markets Union and diversify the funding sources for Europe’s businesses and long-term projects. The Securitisation Regulation should establish a new framework for “simple, transparent, and standardised“ (STS) securitisations. This new initiative also has implications for the overall prudential framework for credit institutions and investment firms, therefore the Commission also proposed to amend the Capital Requirements Regulation (EU) No 575/2013 (CRR) accordingly. Moreover, the proposed regulation incorporates the revised Basel framework . The most significant changes include a new hierarchy of applicable approaches for the calculation of risk-weighted assets and lower capital requirements for STS securitisations. The Commission’s aim is to restore investor confidence in securitisation transactions and contribute to reviving the real economy through increased financing and targeted risk allocation.

The Council agreed a general approach on both regulatory proposals in early December 2015. Both proposals are now considered in European Parliament. Some recent forecasts say that the European Parliament will not probably reach its own agreed position before late 2016. Therefore, it seems likely that the final version of the Securitisation Regulation will be adopted by the Commission in 2017.

20-6-2016

© 2024